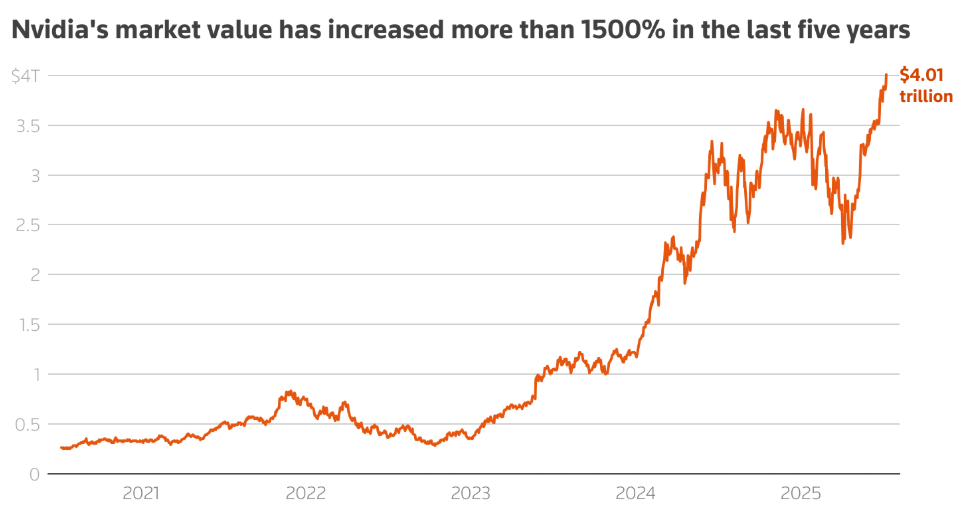

Nvidia Soars to $4 Trillion Valuation Amidst Surging AI Demand

Nvidia, under the visionary leadership of Jensen Huang, has reached an unprecedented milestone, achieving a staggering $4 trillion market capitalization. This monumental valuation underscores the company’s pivotal role in the burgeoning artificial intelligence sector, as insatiable demand for AI infrastructure continues to drive its phenomenal growth. The achievement not only cements Nvidia’s status as a tech titan but also reflects the profound economic shift powered by advancements in AI.

A cornerstone of Nvidia’s dominance is its near-monopolistic grip on the AI infrastructure market. The company boasts a significant technological and historical lead over rivals like Intel and AMD, making it the indispensable provider of the critical computational backbone for AI development worldwide. This formidable market position is further amplified by the immense capital expenditure from tech giants; collectively, Microsoft, Meta, Amazon, and Google are pouring over $300 billion USD into their infrastructure this year, directly translating into colossal revenue streams for Nvidia.

However, this period of unprecedented growth is not without its complexities. Despite the soaring valuation, analysts suggest that Nvidia’s risk profile and inherent uncertainties have subtly but incrementally risen over the past year. A notable concern is the increasing trend of Nvidia’s own major customers exploring and designing their proprietary AI chips, which could introduce future competitive pressures. Furthermore, geopolitical tensions, particularly regarding its China business, including past bans on products like the H20 chips that led to significant inventory write-downs, continue to cast a shadow of unpredictability.

The current all-time high in Nvidia’s stock price is also buoyed by several short-term market dynamics. Eased tariff concerns have contributed to a more favorable trading environment, while speculation surrounding potential interest rate cuts by the Federal Reserve has fueled a broader “risk-on” sentiment across markets. Adding to the positive momentum is the highly anticipated visit of CEO Jensen Huang to China, where he is slated to meet with the premier, a development that could potentially alleviate some of the existing trade uncertainties.

In conclusion, while Nvidia’s ascent to a $4 trillion valuation marks a historic achievement driven by relentless AI demand, the narrative is tempered by an evolving landscape of increasing risks and uncertainties. The interplay of formidable market dominance, strategic customer shifts, and geopolitical factors paints a complex picture for the future. Despite the robust short-term catalysts, the long-term outlook requires careful navigation, as the company strives to maintain its leadership in an ever-more competitive and dynamic global tech arena.

GIPHY App Key not set. Please check settings